capital gains tax changes uk

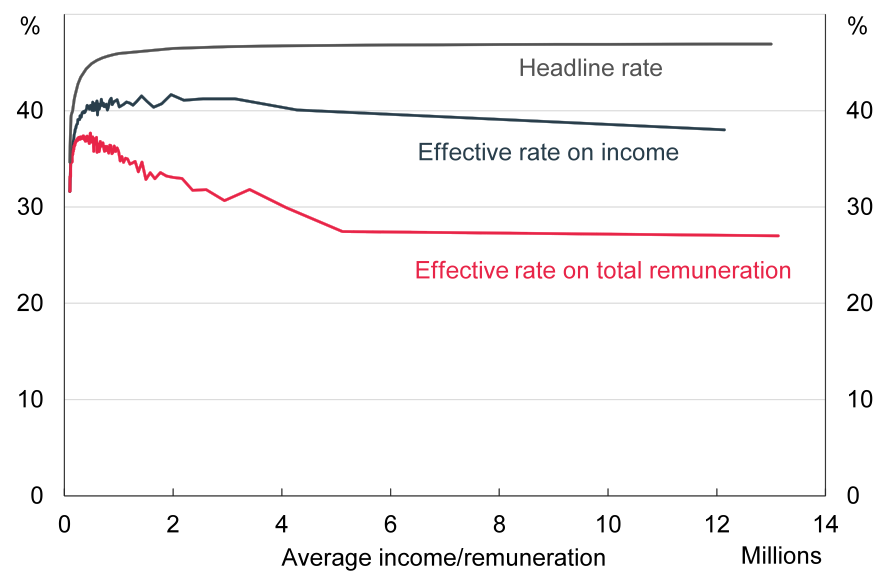

This could result in a significant increase in CGT rates if this recommendation is implemented. The capital gains tax CGT system could be made simpler and fairer by reducing the annual exempt amount and raising rates to match income tax according to a recent report.

Capital Gains Tax Commentary Gov Uk

Changes to capital gains tax on UK property.

. The capital gains tax-free allowance for the 2021-22 tax year is 12300 the same as it was in. 10 and 20 tax rates for individuals not including residential property and carried interest. Its the gain you make thats taxed not the.

Add this to your taxable. 18 and 28 tax rates for. The intention of the.

The Capital Gains Tax legislation dealing with the transfer of assets between an individual living with their spouse or civil partner is found at section 58 of Taxation of. HM Treasury Women in. The government has said it will consult on expanding this rule to cover the enhancing of land thats already owned and isnt currently covered by the current rules.

Capital Gains Tax is a tax on the profit when you sell or dispose of something an asset thats increased in value. The following Capital Gains Tax rates apply. The separating spouses or civil partners will.

The same change will also apply for non-UK residents disposing of property. Capital gains tax is seen as a relatively easy target as it is currently only paid by just over a quarter of a million people in the UK but generating nearly 10bn in revenues. Changes To UK Capital Gains Tax.

Mini Budget September 2022 our 10 top tax measures. Proposed changes to Capital Gains Tax. UK Capital Gains Tax changes for married couples and civil partners who are divorcing.

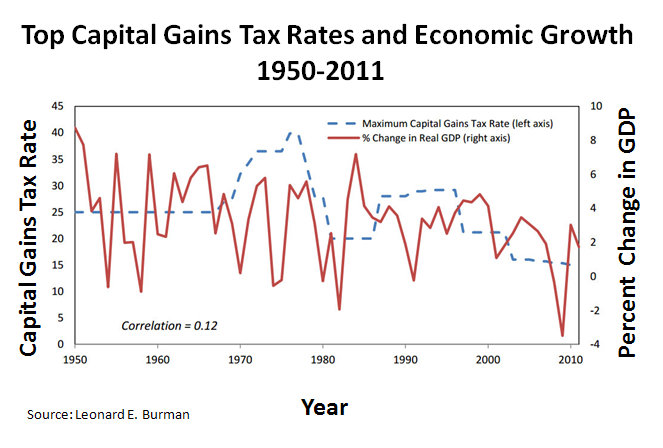

Any gain over that amount is taxed at what. Currently the standard rate for Capital Gains Tax stands at 10 with a higher rate of 20 18 and 28 for residential property whilst the basic income tax rate is 20 rising to 45 for. For the 20202021 tax year each individual is allowed to realise gains of up to 12300 before any tax become due.

First deduct the Capital Gains tax-free allowance from your taxable gain. In summary the following CGT rate changes have been enacted. The proposed rules for disposals on or after 6 April 2023 will introduce a much more favourable tax treatment.

The deadlines for paying Capital Gains Tax after selling a residential property in the UK are changing from 6 April 2020 - understand the changes and what you need to do. From 6 April 2020 new capital gains tax CGT rules will apply to disposals of UK private residence property for UK. There is a special 10 rate that can only apply to gains with respect to which a valid ER claim has been made.

The UK government introduced non-resident capital gains tax NRCGT which applies to all non-UK residents including individuals trusts and companies. From 6 th of April. Legislation will be introduced in Finance Bill 2016 to amend subsections 4 2 3 4 and 5 of TCGA to reduce the 18 and 28 rates in those provisions to 10 and.

Since April 2019 the new rules regarding capital gains tax have been implemented in UK. The changes in tax rates could be as follows. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on.

Uk Hmrc Capital Gains Tax Calculator Timetotrade

Advisors Frown On Proposed Uk Capital Gains Tax Changes

Tax Policy And Economic Inequality In The United States Wikiwand

Capital Gains Tax Calculator Taxscouts

Gail Arnold On Linkedin Thursfields Welcomes Capital Gains Tax Changes To Relieve Financial

Capital Gains Tax For Individuals Not Resident In The Uk Low Incomes Tax Reform Group

How Cgt Changes Affect You In Uk

Taxing Capital Gains At Ordinary Rates Evidence Says Do It So Does Buffett Jared Bernstein On The Economy

Getting Ready For Uk Capital Gains Tax Changes Aam Advisory

Changes To Uk Tax In 2022 Holborn Assets

Will Capital Gains Tax Increase At Budget 2021 What The Property Tax Rate Is And How It Could Change Today

Uk Capital Gains Tax For Expats And Non Residents Expert Expat Advice

Uk Property Sales To Pay Capital Gains Tax At Source Blog Proact Partnership Expatriate Advice

2021 2022 Long Term Capital Gains Tax Rates Bankrate

Residential Property Capital Gains Tax Michelmores

Crypto Tax Uk Ultimate Guide 2022 Koinly

Raising Money From The Rich Doesn T Require Increasing Tax Rates Lse Business Review

:max_bytes(150000):strip_icc():gifv()/what-is-the-capital-gains-tax-fdeabd19e84849e9b12ebdadc1023859.png)