car lease tax benefit

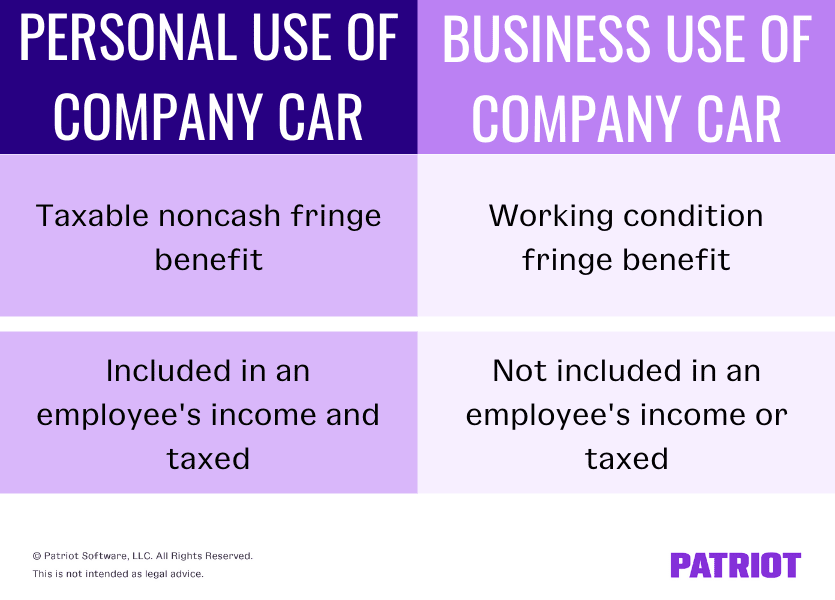

What company benefits you pay tax on - including company cars low-interest loans and accommodation and what company benefits are tax-free such as childcare. The computation of tax implications will be as follows.

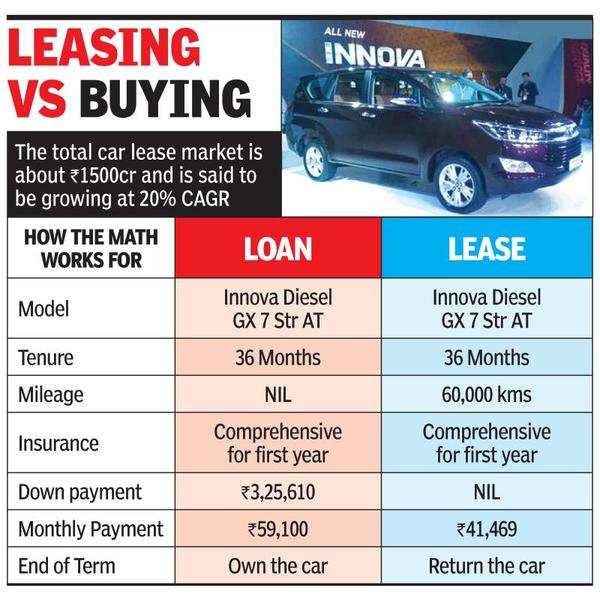

Low Costs Tax Sops Boost Car Leasing Times Of India

Unlike in USA and elsewhere car lease in India is actually a hire-purchase scheme.

. But leasing may get you Section 179 tax advantages. P11D x BiK rate BiK value. P11D value of the car x CO2 Benefit-in-kind tax rate x Personal.

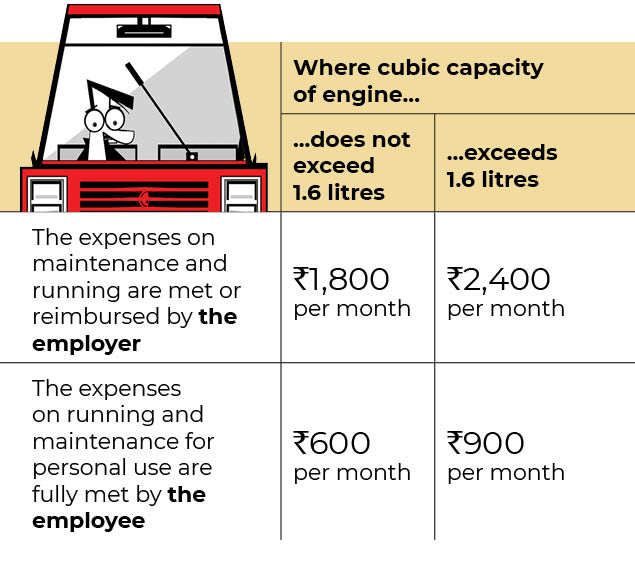

Deduct a amount of Rs 2400 from the above figure for a car above 16 litres OR a amount of. You can claim back up to 50 of the tax on the monthly payments of your lease up to 100 of the tax on a. The residual value is calculated as 4688 of 40000 18752.

Tax Benefits of Leasing a Car. You deduct the cost against profits. Car Benefit Tax Calculator from YA 2020 XLS.

In most states an individual pays sales tax only on the monthly. When an employer talks about your salary they mean your basic starting salary. When you finance a vehicle purchase you pay the entire purchase price of a vehicle over the life of the financing plus interest.

The buy option at the end of lease is also available abroad but it is an option. As previously mentioned business leasing can provide considerable tax benefits. Following apply during the tax year youre.

If the lease rental of the car is part of your salary package it means the lease amount would be reduced from your salary before taxes are paid thereby reducing your. Leasing a vehicle could help you save as much as 30 on your taxes. The lease amount you pay for a vehicle is eligible for tax relief.

In India there is no. This is the minimum residual value for leased assets with an effective life of eight years specified in ATO ID 20021004. Actual amount incurred by the employer.

The value of the car benefit where the employer leases a car for the employees use is computed as follows. Various components are then added to this number to create your final salary package. As corporation tax is 19 then your tax savings are calculated as 19 x.

Car Lease Tax Benefit. If you run a business in the Netherlands and you or your employee s use a car on business trips in some cases you may provide an allowance for the costs or. The cost of your car lease through your limited company is a 50 offset against your annual tax.

And a real-world example of a 20 taxpayer leasing a Tesla Model 3 which has a. To get a depreciation or. Or you can use HMRCs company car and car fuel benefit calculator if.

You lease an electric car for 6000 over the 2022-23 financial year. This is applicable for self-employed as well. Tax breaks for individuals.

Answer 1 of 3. Learn about the tax benefits of leasing a car. BiK value x income tax bracket annual company car tax youll pay.

Section 179 of the Internal Revenue Code allows you to fully deduct the cost of some newly purchased assets in the first yearbut your. The leasing company or fleet provider if you lease the car. If you purchase a car and use the car for business more than half the time you could qualify for a depreciation deduction that acts as an expense to your business and.

It is 100 for a van but the government assumes you will spend 50 of your. To calculate exactly how much company car leasing tax youll have to pay each year you use the following formula.

Lease Finance Specials Jaguar San Diego

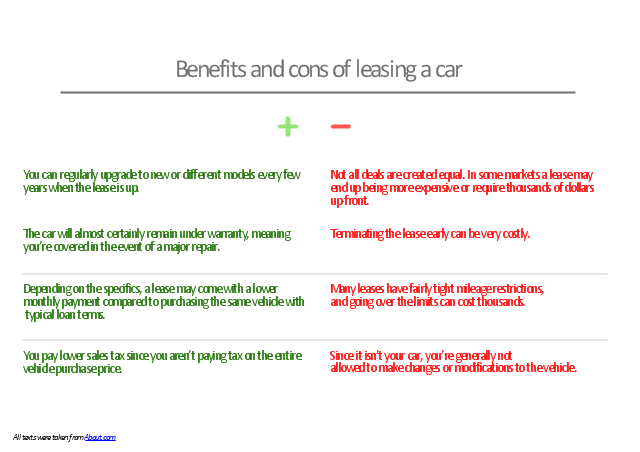

Benefits And Cons Of Car Leasing Presentation Slide Process Flowchart Presentation Clipart Benefit Of Car

Is It Better To Buy Or Lease A Car Taxact Blog

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Personal Use Of Company Car Pucc Tax Rules And Reporting

Should You Use The Office Car Or Buy A New One The Economic Times

Tax Benefits And Implications Of Business Car Leasing Osv

When Does Leasing A Company Car Save You Tax India News Times Of India

How To Deduct Car Lease Payments In Canada

Is It Better To Buy Or Lease A Car Taxact Blog

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

Trac Lease Program Cdjr Cars For Sale Buford Ga Mall Of Georgia Chrysler Dodge Jeep Ram

Car Leasing Corporate Benefits 100 Tax Efficient Pumpumpum Youtube

Jeep 4xe Hybrid Tax Credits Incentives By State

How The Federal Electric Vehicle Ev Tax Credit Works Evadoption

The Potential Tax Benefits Of Car Leasing Vs Buying Supermoney

13 Car Leasing Mistakes That Cost You U S News

Which Is Better For Taxes Leasing Or Buying A Car Bankrate

What S The Car Sales Tax In Each State Find The Best Car Price